Accountant Skill Booster Membership

Stay one step ahead with Tyariexamki Membership

Easy & Affordable monthly Subscription

Master In 8 Career Boost-up Tally | Busy | GST | Income Tax | TDS | PF | ESI | Excel Live Courses

250+ Hours Practical-Based Training | 100+ Assignment | Test Series | Course Certificates

Daily Live Classes by 6 Expert Mentors

CMA Gaurav Kumar

FCMA, B.Com (H) — Faculty: GST & Income Tax

22+ Years Experience

Mr. Punit Singh

B.Com — Faculty: GST

20+ Years Experience

Heena Naresh Chohan

MBA (HR) — Faculty: HR & Payroll

10+ Years Experience

Mr. Punit Sharma

B.Com — Faculty: PF & ESI

26+ Years Experience

Mrs. Amrita Rai

CA Finalist, LLB, MBA, ACCA — Faculty: Income Tax & TDS

11+ Years Experience

Mr. Kamlesh Sunil bhai Vaghela

B.Tech, MBA (HR) — Faculty: Microsoft Excel

11+ Years Experience

Why Join This Membership?

Unlock real skills, real certifications & real career growth — all in one powerful subscription plan designed by India’s top accounting mentors.

You Get All These Premium Benefits:

- 8 Premium Courses

- 6 Top Expert Mentors

- Daily Live Class

- Notes + Assignments

- Course Test Series

- Certificates for each course

- Live Doubt-Solving Sessions

- E-Journal on Latest Tax Updates

- Premium Community Group

- Free Vacancy Opening Updates

Who Should Join?

This membership is ideal for students, fresh graduates, working professionals, and career changers who want practical accounting, GST, and Taxation skills to become career-ready or earn better.

COURSE INCLUDED

Master practical accounting in Tally Prime, including GST, inventory, MIS reports, vouchers, reconciliation, and automation — from zero to expert level.

Learn complete Busy setup, accounting, GST billing, reports, inventory, data management, and compliance tools used widely in trading and manufacturing businesses.

Understand all ITR forms, income heads, deductions, AIS/TIS, online filing, compliance rules, and practical hands-on return filing.

Become skilled in TDS deduction, compliance, returns filing, payment process, correction statements, 26Q/24Q filing — 100% practical training.

GST registration, returns (GSTR-1, 3B, 9), ITC rules, reconciliation, notices reply, portal operations, and real-life GST compliance case studies.

Learn EPFO portal, UAN, KYC, challans, returns, payroll connection, compliance handling, and employer requirements for PF.

End-to-end ESIC portal training, employer registration, employee addition, contributions, challans, returns, and compliance workflows.

Excel functions, formulas, pivot tables, MIS reporting, data analysis, automation shortcuts — from beginner to professional mastery.

Income Tax Return (ITR) E-Filing

ITR e-Filing 1 to 5. ITR forms, income heads, deductions, AIS/TIS, online filing, compliance rules, and practical hands-on return filing.

GST E-Filing

GST registration, returns (GSTR-1, 3B, 9), ITC rules, reconciliation, notices reply, portal operations, and real-life GST compliance case studies.

PF E-Filing Course

Learn EPFO portal, UAN, KYC, challans, returns, payroll connection, compliance handling, and employer requirements for PF.

ESI E-Filing

End-to-end ESIC portal training, employer registration, employee addition, contributions, challans, returns, and compliance workflows.

Tally Prime (Basic to Advanced)

Master practical accounting in Tally Prime, including GST, inventory, MIS reports, vouchers, reconciliation, and automation — from zero to expert level.

Busy Accounting Software

Learn complete Busy setup, accounting, GST billing, reports, inventory, data management, and compliance tools used widely in trading and manufacturing businesses.

Microsoft Excel

(Basic to Advanced)

Excel functions, formulas, pivot tables, MIS reporting, data analysis, automation shortcuts — from beginner to professional mastery.

TDS E-Filing

Become skilled in TDS deduction, compliance, returns filing, payment process, correction statements, 26Q/24Q filing — 100% practical training.

Membership Pricing

Choose Your Plan

Monthly Plan (Pay Small, Learn Big)

-

Monthly Access

-

Auto-Renewal (Cancel Anytime)

-

Subscribe Now

Annual Plan (Best Value – Most Popular)

-

Save extra ₹719

-

Full Access to All Courses & Benefits

-

Subscribe Now

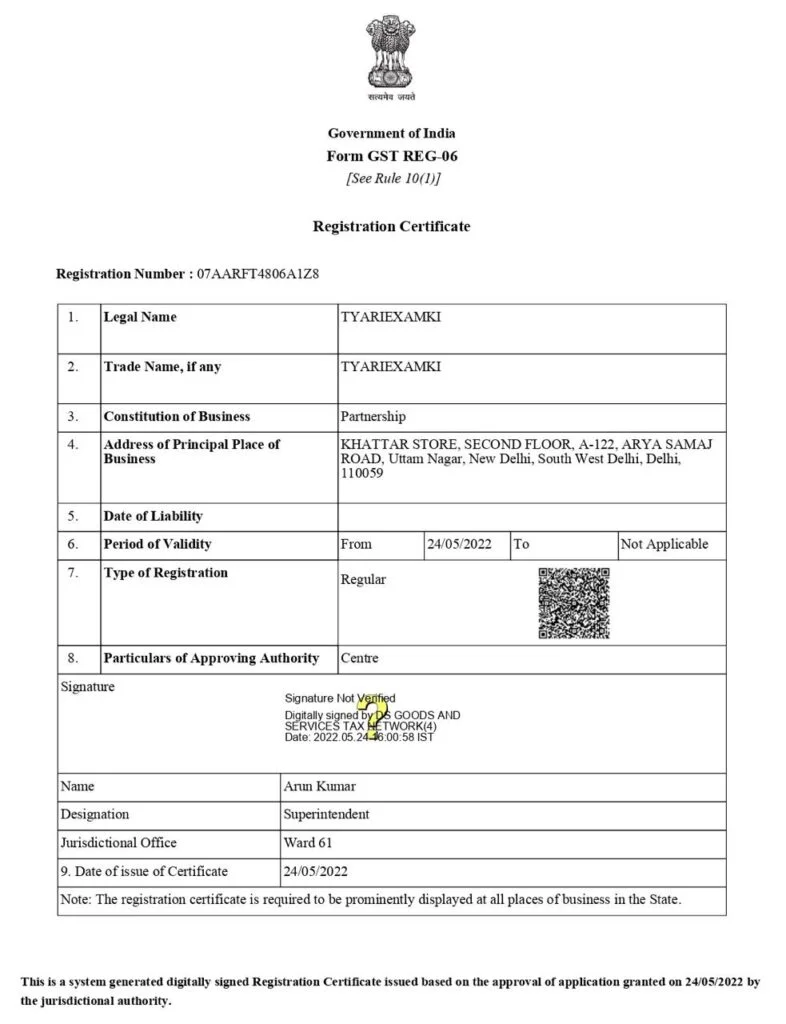

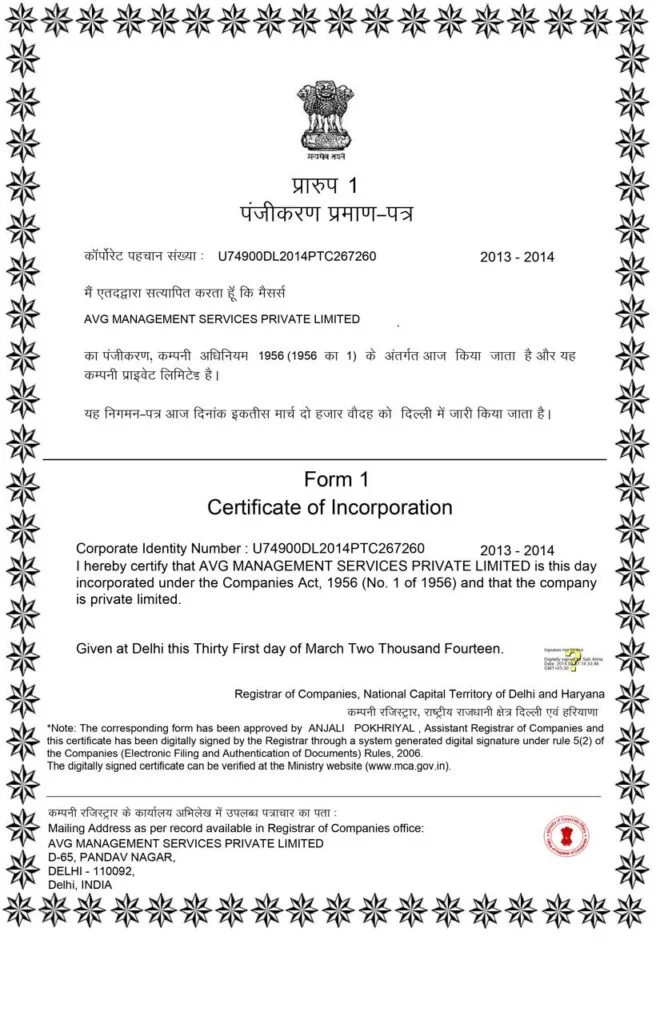

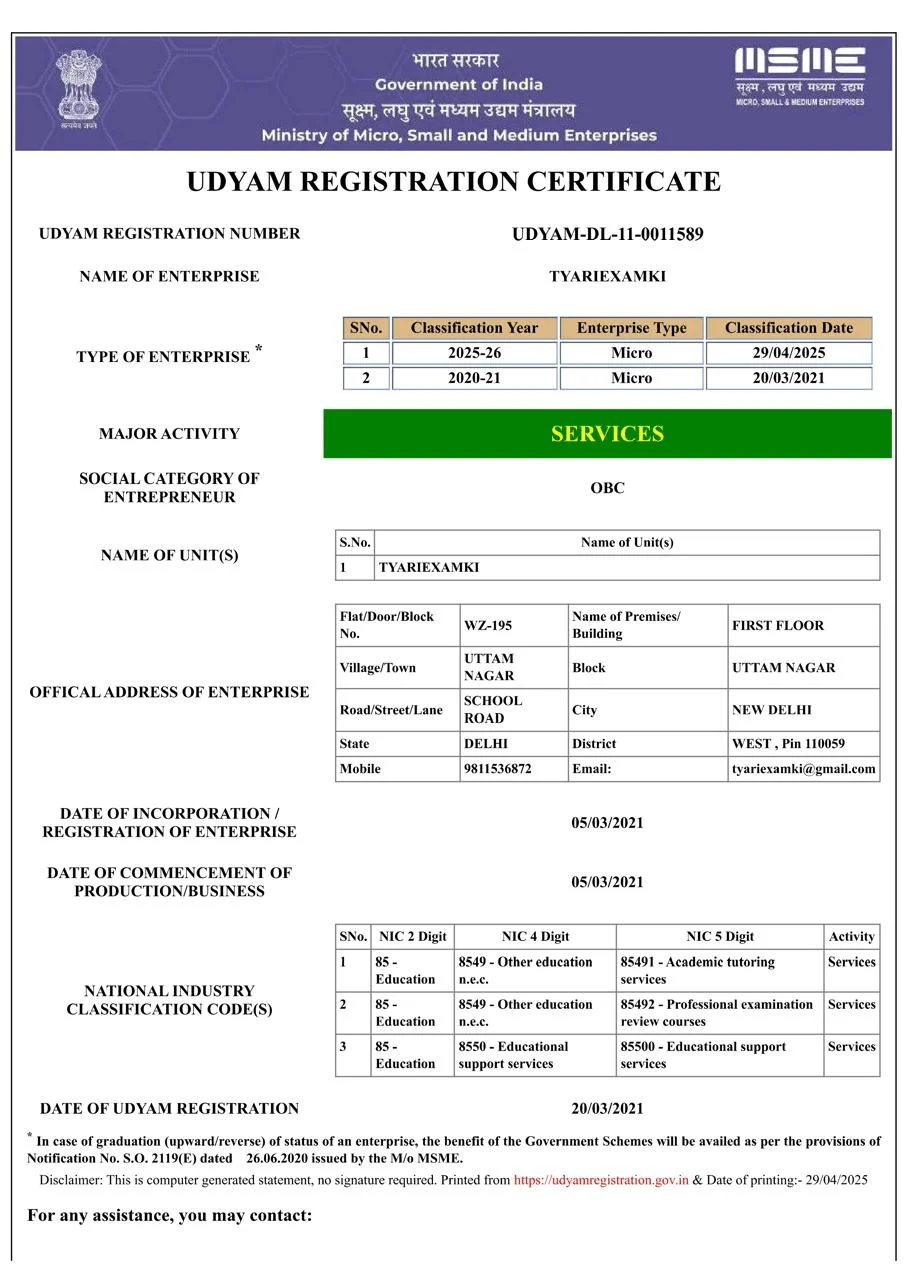

Our Trust & Legacy

14-Year-Old Registered Institute

Registered Under MCA

ISO Certified

Thousands of Successful Students

Testimonials

Accountant Skill Booster gave me hands-on training, sharper accuracy, faster reporting skills, and the confidence to handle real clients independently.

Frequently Asked Questions

Yes! You get separate, recognized certificates for each course you complete.

Absolutely. You can start even with zero accounting knowledge.

Yes — 100% practical videos, demonstrations, assignments, and test series.

Yes, you get 24×7 access during your membership.

Weekly sessions are conducted on Zoom/Google Meet with mentors.

Yes, we provide free vacancy opening notifications regularly.

You get instant access to the learning portal and all course materials.

Yes, the monthly plan includes easy, anytime cancellation and auto-renewal.

Digital courses are non-refundable as per policy.

A laptop is recommended but most lessons can be watched on mobile too.

Be Certified upon Successful Course Completion.

This certificate validates the successful completion of the online training Course by Tyariexamki. It represents dedication, knowledge, and expertise in ROC Incorporation and Compliance Filing.

Company Certificates

From Management Helpdesk

Tyariexamki a 11-Year-old premier Institute run and managed by AVG Management Services Private Limited that serving education and Practical training to students all over India since 2014. Tyariexamki is an effort to create abilities in job seeking students, after passing 10th, 10+2, undergraduate and fresh graduates, Postgraduate and Professional Choosing the right career program is one of the most important decisions that you will make in your life. In the highly competitive global environment, the role of communication and public speaking will be crucial for aspirants to flourish in the 21st century. Keeping the future global business competencies in mind, has formulated a unique Scheme of Education and Training. The new scheme has been upgraded, revised and refined keeping in mind the Indian & global requirements, aligned with Practical Training of the subjects, which will prepare and groom the new professionals to match the future requirements.

Start Your Membership Today — Become a Skilled Accountant!